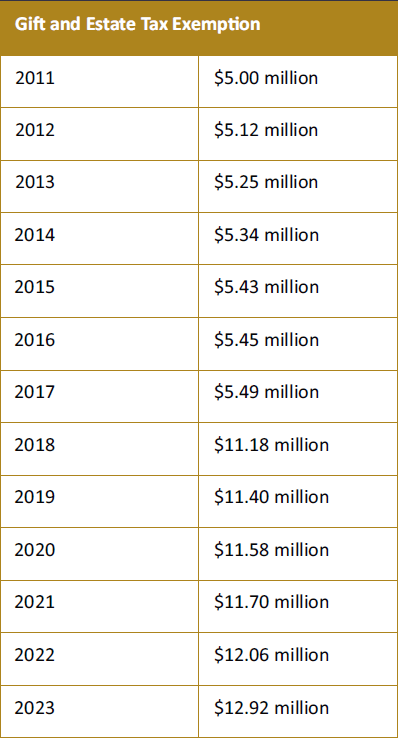

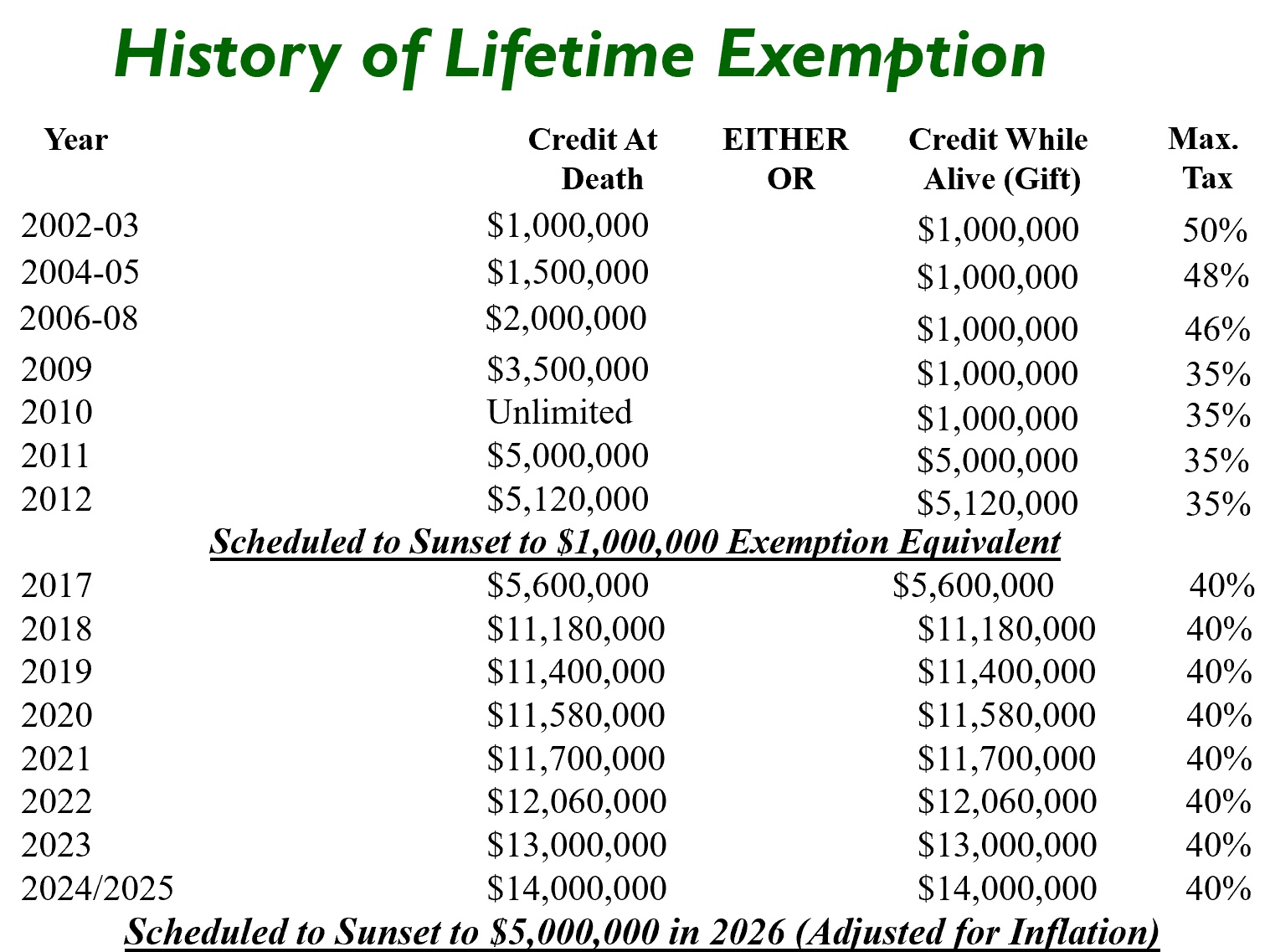

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023

4.6 (634) · € 28.99 · In Magazzino

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

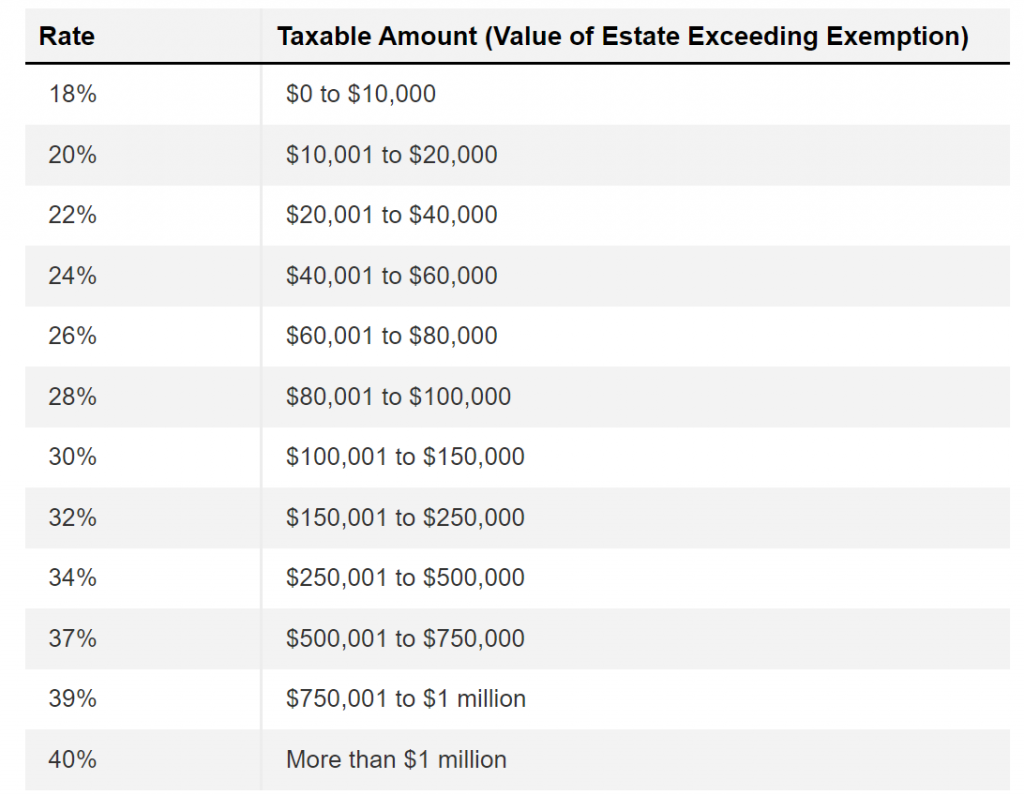

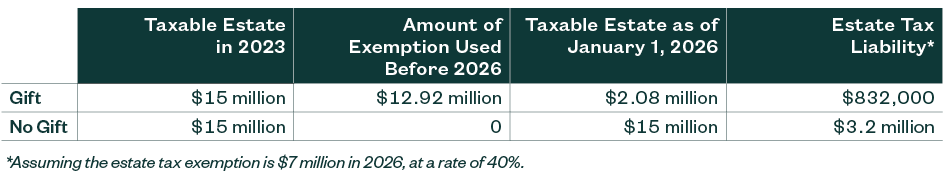

The Estate Tax and Lifetime Gifting

2023 Estate and Gift Tax Update - Paul Premack, Probate & Estate Attorney

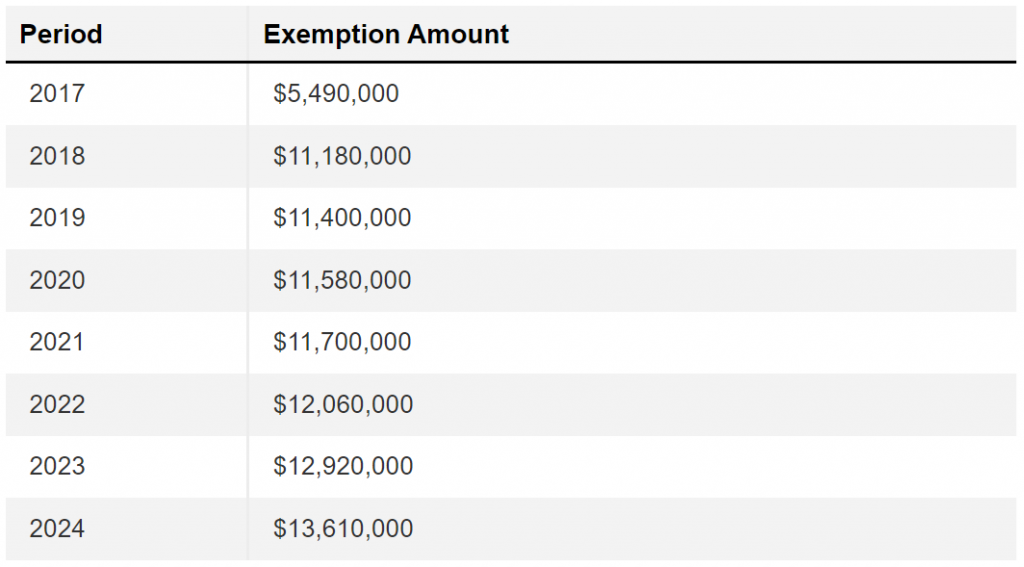

IRS Raises Estate Tax Exemption Amount for 2024 - CPA Practice Advisor

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023

Federal Taxation of Individuals in 2023

Gift Tax Limit 2023 Explanation, Exemptions, Calculation, How to Avoid It

Inflation Adjustment for GST, Gift, and Estate Tax

I Want To Help My Son Buy A House — If I Give Him $30,000 For The Down Payment, Will I Pay A Gift Tax? Do I Need To Report This To The IRS?

IRS Estate Tax Exemption Amount Goes Up for 2023

2023 Estate Tax Limits Announced

IRS Raises Estate Tax Exemption Amount for 2024 - CPA Practice Advisor

Inflation causes record large increase to lifetime gift exemption

Estate Tax Exemption for 2023